BancaSure360

Unlocking the future of bancassurance

An end-to-end bancassurance platform for omni-channel sales, designed to transform how banks deliver insurance products to their customers. Banks can effortlessly launch multiple products from different insurance partners, faster than ever, and across all channels. For insurance companies, this means radically accelerating product launches through their partner banks, creating new opportunities for growth. With zero upfront costs and unlimited scalability, BancaSure360 enables massive sales with minimum risk and ΙΤ resources.

Omni-channel sales without barriers

With BancaSure360, distributing insurance products has never been simpler! Imagine effortlessly offering both existing and new insurance products across branches, web, mobile, and phone banking - all through one unified platform, accelerating deployment and simplifying operations. Give your customers the power to buy insurance their way, with the freedom to begin their journey in one channel and seamlessly complete it in another. For example, a customer can receive a quote at your branch, then complete the purchase online at their convenience.

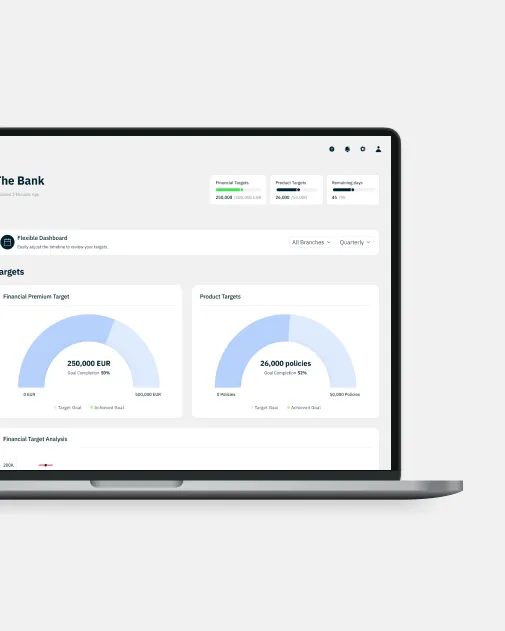

An end-to-end solution, offering measurable performance insights

BancaSure360 streamlines the entire customer journey, seamlessly managing everything from initial policy quotations and purchases to claims and renewals. Our platform offers real-time visibility into sales performance and claims tracking, all integrated into a single, user-friendly solution. Your entire organization, from the bancassurance director and branch managers to sales agents, can use BancaSure360 for a variety of functions, from driving sales and managing operations to accessing individual and team-wide performance data, ensuring transparency, accountability, and success at every level.

Gain independence and flexibility – switch insurance partners at any time

Being stuck in lengthy roadmaps, constrained by limited resources, and held back by delays is a thing of the past. Our insurer-agnostic platform gives you all degrees of freedom to collaborate effortlessly with additional insurance partners. No need to wait a year or more to launch a new product with your current partner. Our solution enables seamless integration with multiple insurers, allowing you to bring products to the market faster and seize revenue opportunities without delay.

BancaSure360

key features that drive success

Plug & play solution, minimal effort,

zero cost & risk

Wallbid, a global insurtech provider, blends cutting-edge technology with innovative insurance products to deliver end-to-end solutions for partners around the world. We enable our partners to launch innovative insurance offerings in just weeks, eliminating insurance-related hassle and delays.

Zero CapEx solution.

Innovative insurance products, underwritten by tier-1 reinsurers and insurers.

High-tech platform - seamless API integration.

Fully digital customer experience from buying a policy to filing a claim.

Web portal for real-time monitoring of sales and KPIs.